Can FNOL [First Notice of Loss] Reduce Fleet Claim Costs?

Submitting a First Notice of Loss promptly can help reduce fleet claim costs by enabling your insurer to step in early and ensure communication with involved parties.

First notice of loss can impact fleet claim costs by allowing your claims team to intervene and communicate with all parties involved. Providing accurate information, evidence and witness details is the most effective way to reduce fleet claim costs for yourself and your insurer.

Find out more about the importance of first notice of loss today.

What does First Notice of Loss mean?

First notice of loss refers to the initial report made to your insurance company following an incident such as an accident, damage or theft.

FNOL is the first step in the claims process, and contains personal information from the policyholder, as well as details regarding the date, time and location of the incident for which you are claiming.

Understanding the FNOL procedure

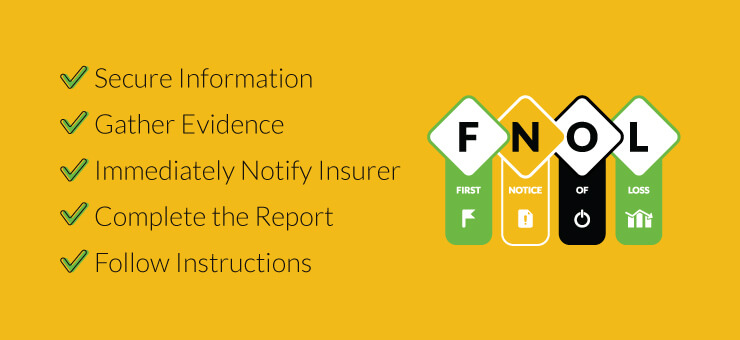

The usual FNOL procedure following an accident is as follows:

Get Your Free Fleet Insurance Quote

As the UK’s leading fleet insurance specialists, we work with the UK’s largest insurance providers for fleets to get you an instant, hassle-free policy.

Why First Notice of Loss is important for your business and fleet

First notice of loss is crucial for the effective management of claims, saving time, money and stress for your business.

The earlier a claim is reported, the higher the chance of accurate evidence being collected including dashcam footage, photos, witness statements and more. It also makes exaggerated or inaccurate third-party claims less likely.

Can FNOL reduce fleet claim costs?

Effective FNOL use significantly reduces fleet claim costs in most cases. It facilitates quick intervention, more accurate claims management and even faster repairs:

Chat to Us

Rather get a policy created over the phone? Speak with our experts now:

Get a Quote

Get a quick quote from an insurance professional with our easy form and a few details:

How First Notice of Loss affects your fleet

FNOL affects your fleet in a number of ways. It prevents third-party claimants from seeking support from more expensive credit hire organisations and claims businesses, which would significantly increase claim costs and drive up your insurance premiums when renewing.

FNOL carried out as soon as possible puts your claims team in control of the claims process, so they can secure crucial evidence such as photos and witness details, preventing higher costs for your fleet.

Also, a quick notice of loss initiates all claims, communications and repair processes immediately, which mitigates the amount of time the vehicles in your fleet have to stay off the road for.

At FleetCover, we know that your fleet is vital to business operations, and fast repairs and recovery are one of the most important factors of fleet insurance. That’s why we’d recommend understanding the full importance and effect of first notice of loss, and making all fleet vehicle users aware of the importance of fast notice.