Compactor Insurance

Like most plant equipment and vehicles, your compactor fleet needs a comprehensive insurance plan to cover against all potential claims.

Compactor insurance is a type of plant fleet insurance that protects compactors, either owned or hired-in, against damage, theft and more. FleetCover specialises in providing bespoke protection plans for your business fleets of all sizes.

We’re pleased to offer free online quotes for all your construction equipment and vehicular needs, including compactors.

What is specialist Compactor Insurance?

Specialist compactor insurance is a type of cover which takes into account the specific needs, requirements and risks involved with owning or hiring compactors. What this means is that we understand the type of cover you’re looking for, and we can provide you with exactly what you need, for the specific number of vehicles you need.

Special types insurance covers niche and specialist equipment in your fleet.

Does a compactor need insurance?

A compactor does need insurance, just like all other machinery and vehicles. Technically, it’s not a legal requirement to seek additional compactor insurance, but from a business perspective, it certainly makes sense to for two reasons:

First of all, compactors are highly expensive pieces of machinery. They cost a lot to own, rent, repair and maintain. As a result, paying insurance premiums to protect against the cost of replacement or major repairs is a no-brainer. Without this insurance, you could end up spending a whole lot of money replacing your fleet after damage.

Secondly, compactors tend to be used in construction or agriculture, which usually means they’re in dangerous and higher risk areas, increasing the chances of damage. So, despite the fact they’re sturdy machines, they are still relatively likely to become damaged.

Speak to FleetCover for compactor insurance ranging from mini fleet insurance all the way to larger fleets.

Contractors’ Plant and Equipment Insurance

If you’re a contractor looking for plant and equipment insurance, look no further than FleetCover. We know that managing a plant fleet will include the organisation and supervision of farming, agricultural or construction vehicles, which are utilised to optimise construction or farming.

Contractors’ plant and equipment insurance covers hired and owned in-plant machinery against theft, accidental damage, fire damage, third party risks and more. It’s vital to cover all bases in order to protect against expensive repairs, replacements, or claims.

Check out our owned and hired plant insurance checklist.

What does Compactor Insurance cover?

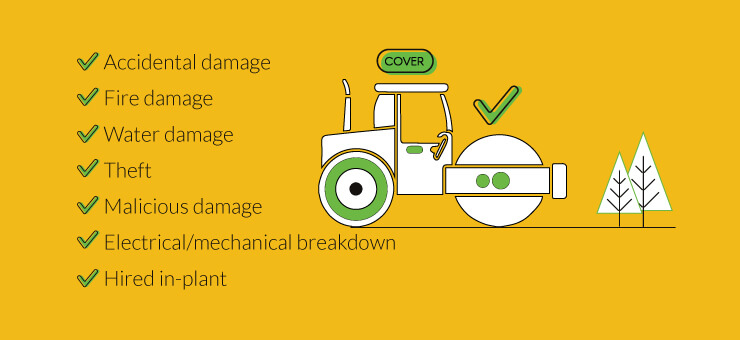

Compactor insurance can cover a range of things, including:

- Accidental damage

- Fire damage

- Water damage

- Theft

- Malicious damage

- Electrical/mechanical breakdown

- Hired in-plant (you’re not liable for costs if rented equipment is lost, damaged, or stolen)

Remember, insurance policies vary drastically from plan to plan, and our mission is to make sure you’ve got the cover you need, and no more. That way, we can ensure that your compactor fleet is protected, without additional features that you don’t need costing you excess money.

Types of cover for plant and construction fleets

The different types of main plant and construction fleet cover include:

- Owned plant insurance – Designed to protect plant equipment which is owned by your company. This protects against expensive repairs or replacements.

- Hired in-plant insurance – Vital for companies who rent or lease heavy machinery from other companies. This protects against financial liability if vehicles are damaged or stolen.

- Construction fleet insurance – A package includes various elements of coverage tailored to your construction company’s specific needs. It can cover a variation of vehicle and equipment types, which is cheaper and has lower admin needs than opting for different policies across the board.

There are also some extra forms of insurance which should be considered for some businesses:

- Public liability – Important to protect against claims for injury or property damage as a result of your business activities.

- Employers’ liability – Often a legal requirement, provides cover against claims from employees regarding work-related injuries.

- Goods in transit – Cover goods, materials and equipment whilst they are being transported.

It’s likely that your construction company needs a unique set of insurance types for your compactors and other construction or agriculture equipment. FleetCover is here to find the perfect plan for you, at the best possible price. Get in touch with us to find out more.