Crane Insurance

Crane insurance protects your business against the risks and hazards which come with using, or renting out cranes. Find a bespoke policy today.

Crane insurance usually protects the operator of a crane, and the business who has leased it out to a third party. It is designed to protect against accidental damage, vandalism, fire damage and much more.

FleetCover is here to help find a bespoke crane insurance policy to suit your needs. We’ll take your individual requirements into account before finding the perfect fleet insurance policy for you.

What is Crane Insurance?

Crane insurance, often referred to as ‘crane hire insurance’ protects organisations that hire their cranes to other businesses in construction and agriculture. Such expensive machinery needs to be properly protected, seeing that is the main asset of your crane hire business. A fleet of cranes can be protected under one policy, keeping costs and admin to a minimum.

Crane insurance can be taken out for individual cranes, but fleet policies have a number of benefits over singular ones. Read more about fleet insurance vs individual policies.

Construction fleet insurance for cranes

Construction fleet insurance for cranes covers a few different bases, including public liability insurance in case your cranes experience an unexpected issue that causes injury or damage to public property. Legal action can still be taken against you, even if the incident wasn’t your fault, so get protected today.

If it’s not just a fleet of cranes you need to cover, and you’re actually looking to include other construction based vehicles, construction fleet insurance may be a better choice for you!

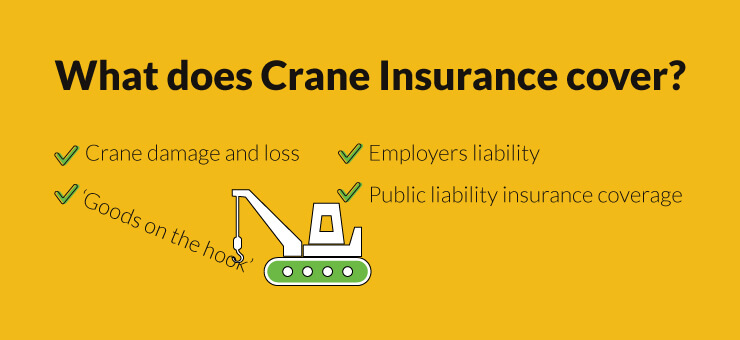

What does Crane Insurance cover?

Under a comprehensive crane insurance policy, the following is usually covered:

- Crane damage and loss – Whilst ‘loss’ is unlikely with such large equipment, these policies cover all accidental damage and theft of parts.

- Employers liability – This protects your business in the event of claims made by your employees, if they get injured as a result of the crane.

- ‘Goods on the hook’ – A phrase referring to the items being lifted and moved by the crane. Damage or loss to this equipment or materials would be covered under certain policies.

- Public liability insurance coverage – Protects against third party claims, resulting from property damage or injury caused to a member of the public (external from your organisation).

Finding the right fleet insurance policy means understanding exactly what you do and don’t need in your specific plan. That’s where Fleetcover can help; speak to us for expert advice.

Types of cover for crane fleets

There are a few different types of cover for crane fleets:

- Equipment cover

- All risks cover

- Public liability insurance

- Employer’s liability insurance

- Goods on the hook cover

- Hired-in plant cover

- Business interruption insurance

Can a crane be insured for moving to different sites?

A crane can be insured for moving to different sites/locations, but the type of coverage you’ll need depends on the type of crane(s) you’re covering, and how it will be moved.

For example, road risks coverage will cover against accidents, theft or damage caused specifically whilst the crane is being transported on a public road. You can also get covered during all the stages of dismantling, loading, unloading and more. This is known as ‘machinery movement insurance’.

Mobile crane cover

Mobile crane cover ensures that no matter the size or type of crane(s) you have in your fleet, you’ll be adequately protected against damage and loss, as well as accidental damage to public property.

Hiring out and using a crane is hazardous and comes with a number of risks which are unavoidable. Covering your business against these risks associated with a mobile crane is vital.

Check out if you qualify for fleet insurance.

Why work with FleetCover to insure your crane fleet

Insuring a crane fleet is usually quite confusing, and there are a number of technicalities and finer details which impact on the kind of coverage you need. Ending up with the wrong coverage could end up costing you millions of pounds, and seriously harm your business operations.

Working with FleetCover guarantees that you’ll have the right insurance policy for your crane fleet, as we take the time to understand your business and its specific needs, including how you operate and transport your equipment. You’ll also save a lot of money by using a fleet policy as opposed to individually insuring each crane.