Is Your Fleet Insurance Adapting to EV Transition Risks?

As more fleets go electric, insurance needs to evolve too. Here we explain how smart EV insurance strategies can safeguard your operations and sustainability goals.

Fleet electrification is accelerating - fast. Regulations, customer expectations, and sustainability targets are driving logistics and supply chain leaders to invest heavily in electric vehicles (EVs), charging infrastructure, and new ways of operating.

The benefits are obvious: lower running costs, protection from fuel price volatility, and a stronger sustainability story to tell customers and investors. But as attention focuses on vehicles, batteries, and charging, one crucial area often gets left behind – EV fleet insurance.

Traditional fleet policies weren’t designed for electric vehicles. Without tailored cover, operators risk longer EV downtime, higher repair costs, and supply chain disruption that undermines the business case for electrification.

How electric vehicles change the risk profile

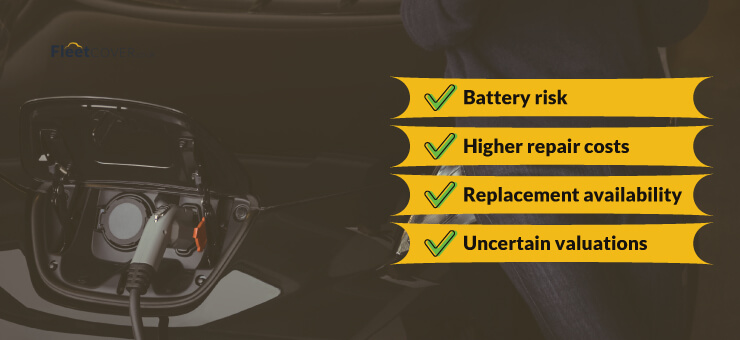

Switching from internal combustion to electric power changes a fleet’s risk exposure in several important ways:

Ultimately, assuming a standard fleet insurance policy will seamlessly cover EVs can leave operators exposed to gaps they didn’t expect.

The supply chain impact of EVs

When an electric vehicle is off the road for weeks awaiting specialist repair, the effects can ripple far beyond the fleet yard. Missed deliveries disrupt production, delay customer orders, and can even trigger penalty clauses.

Learn More About Electric Fleet Insurance

As the UK’s leading fleet insurance specialists, we work with the UK’s largest insurance providers for fleets to get you an instant, hassle-free policy.

Key questions for fleet managers and logistics leaders

As you scale up your electric fleet, make sure your EV insurance strategy keeps pace and be sure to ask your broker or insurer:

- 1Does our policy specifically cover EV-related risks such as batteries, chargers, and specialist repairs?

- 2Is business interruption insurance included if vehicles are grounded for extended periods?

- 3What’s the policy on replacement vehicles? Are EV-compatible alternatives guaranteed?

- 4How will premiums evolve as EV adoption increases and claim data matures?

Clarity on these points will ensure your EV insurance strategy supports rather than hinders operational and sustainability targets.

Turning insurance into an enabler for electrification

At FleetCover, we’ve seen how easily businesses can be caught off guard from unexpected write-offs to months of downtime. But with the right guidance, EV fleet insurance can become a strategic advantage.

Working with a specialist broker can help you to:

Fleet electrification isn’t optional anymore but to make the transition safe, sustainable, and financially viable, insurance needs to evolve alongside it.

When your policy matches the risks you actually face, you’re protecting more than your vehicles — you’re safeguarding your supply chain, your reputation, and your long-term business resilience.

Chat to Us

Rather get a policy created over the phone? Speak with our experts now:

Get a Quote

Get a quick quote from an insurance professional with our easy form and a few details: